Tax Appointment Checklist

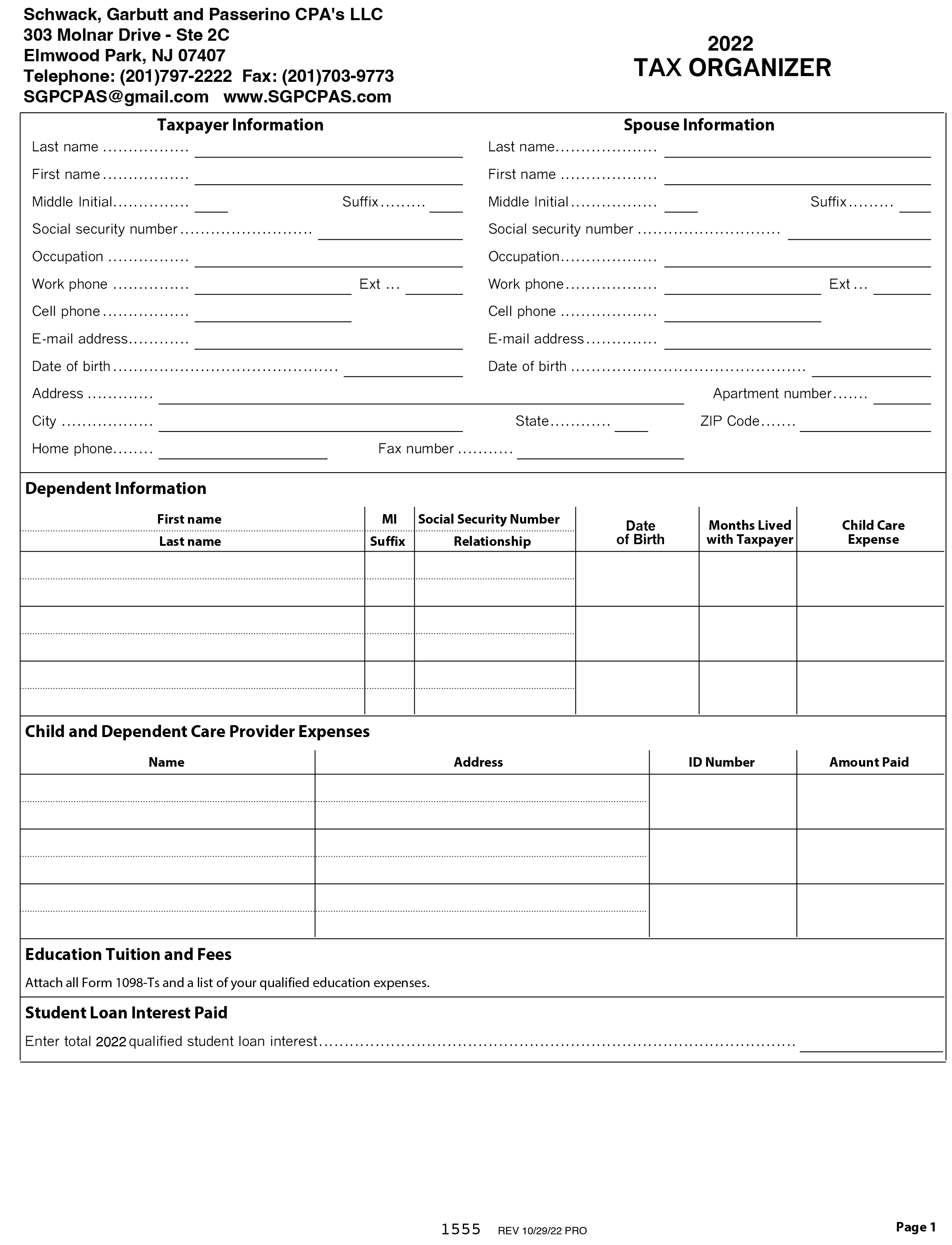

Personal Information

- Prior year Federal and State(s) income tax returns for new clients

- Name, address, Social Security number and Date of Birth for yourself, spouse and dependents

- Banking information if Direct Deposit Required

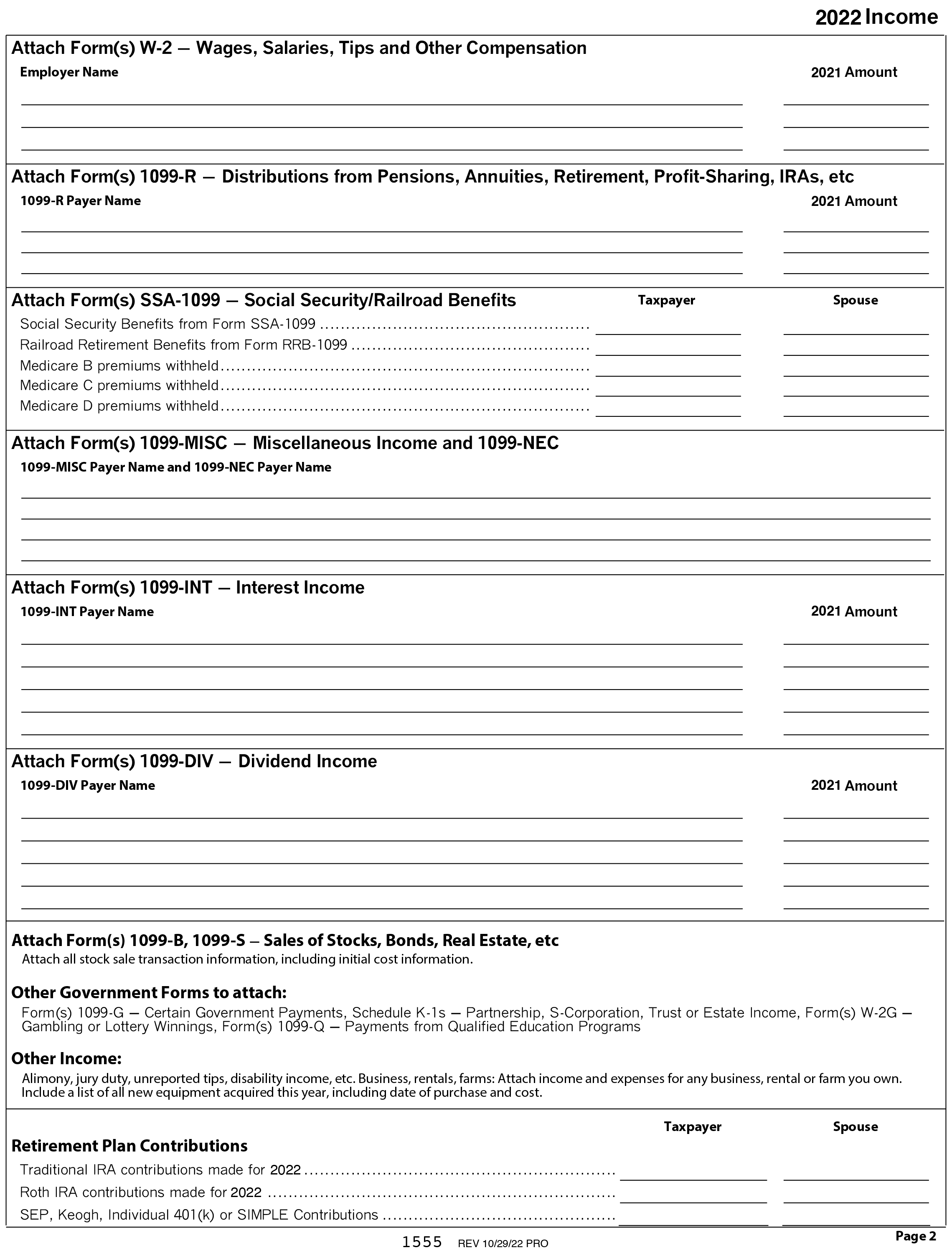

Income Data Required

- Wages and/or Unemployment

- Interest and/or Dividend Income

- State/Local income tax refunded

- Social Assistance Income

- Pension/Annuity/Stock or Bond Sales

- Contract (1099)/Partnership/Trust/Estate Income

- Gambling/Lottery Winnings and Losses/Prizes/Bonus

- Alimony Income – (Date of Divorce)

- Rental Income

- Self-Employment/Tips Income

- Foreign Income

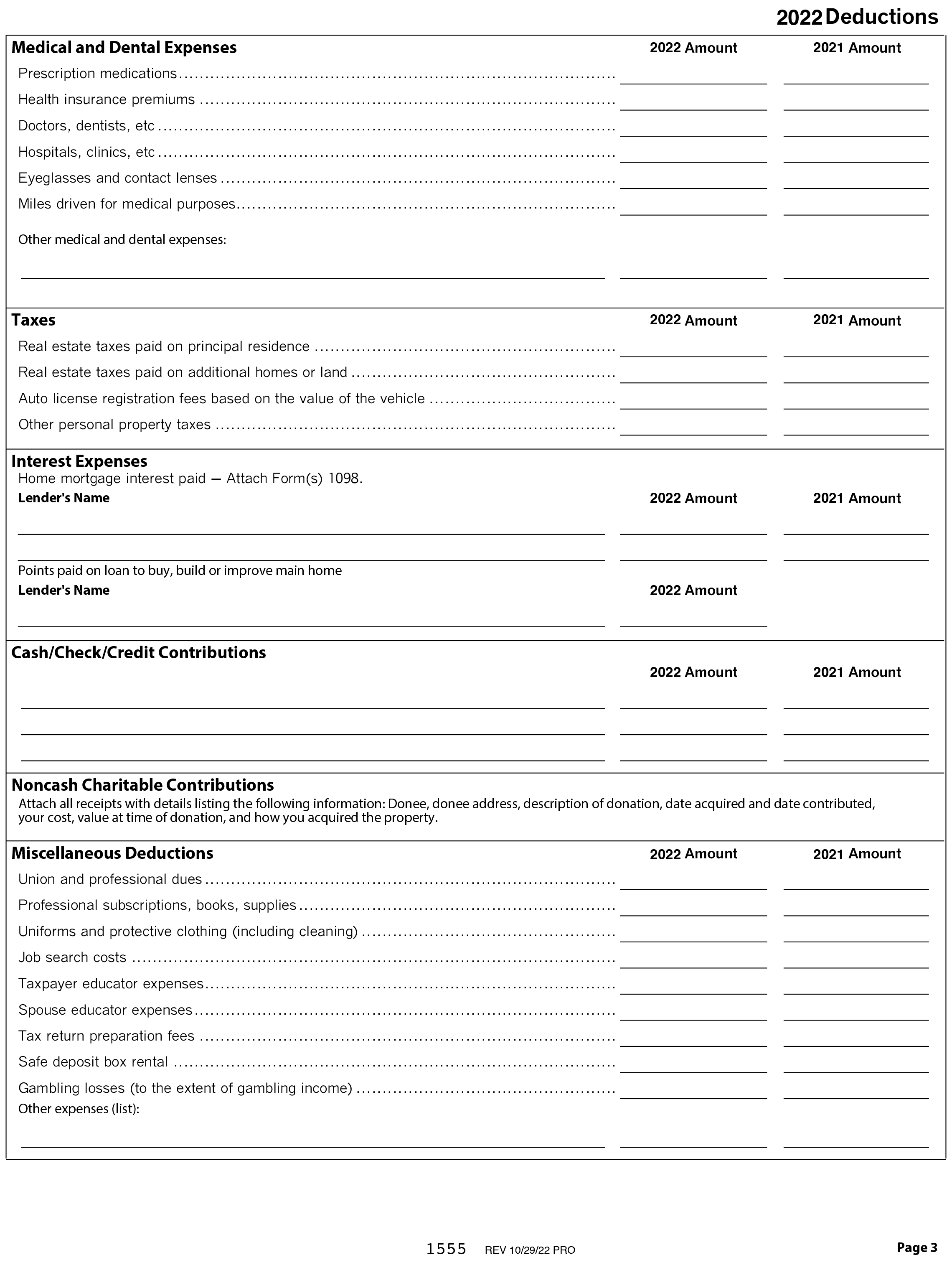

Expense Data Required

- Dependent Care Costs (Name, Address, Phone and Tax ID)

- Education/Tuition Costs/Materials Purchased

- Medical/Dental

- Mortgage/Home Equity Loan Interest/Mortgage Insurance

- Employment Related Expenses

- Gambling/Lottery Expenses

- Tax Return Preparation Expenses

- Investment Expenses

- Real Estate Taxes

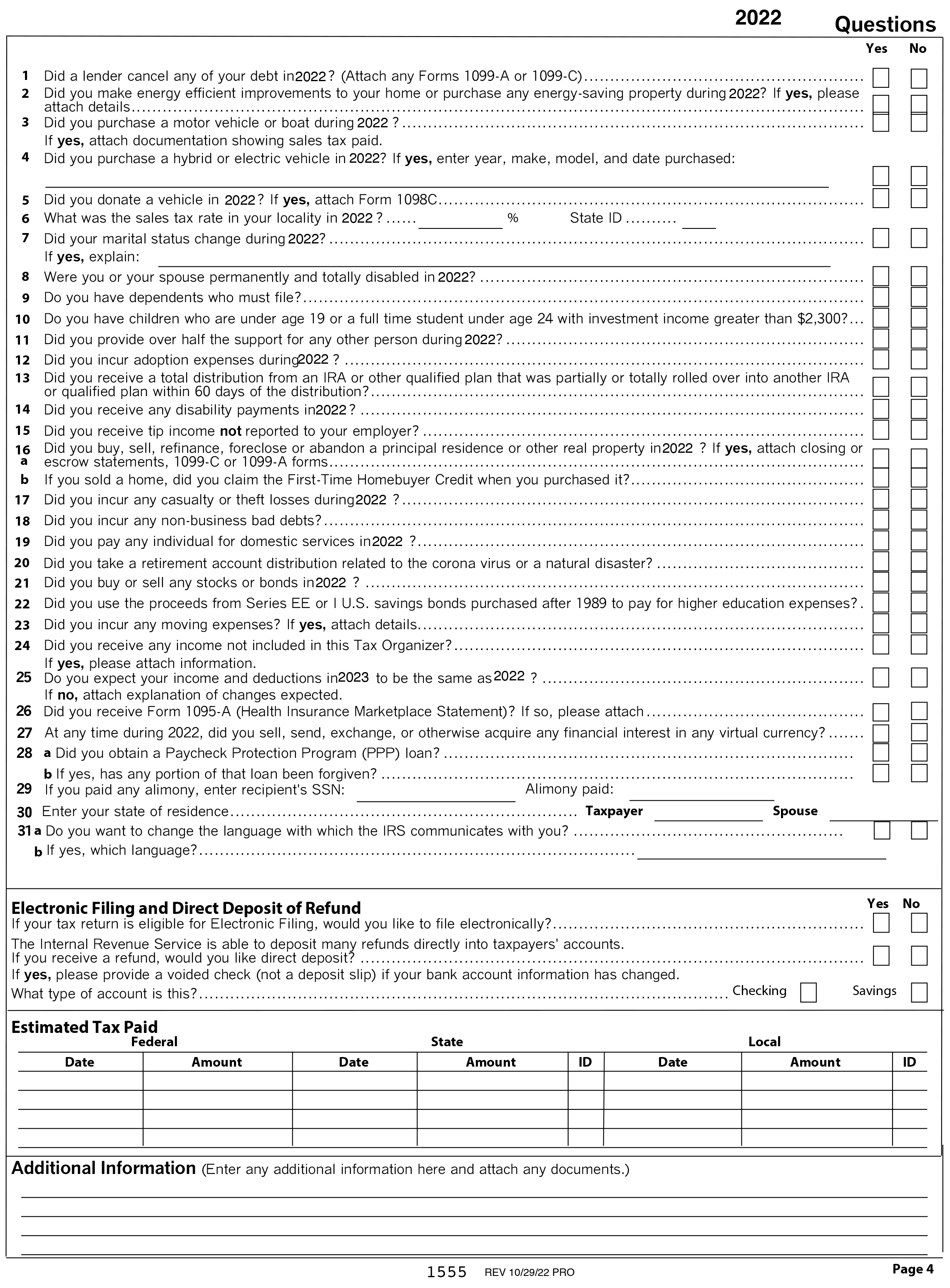

- Estimated Tax Payments to Federal and State Government and Dates Paid

- Home Property Taxes

- Charitable Contributions Cash/Non-Cash

- Purchase qualifying for Residential Energy Credit

- IRA Contributions/Retirement Contributions

- Home Purchase/Moving Expenses

- Self-Employment Business Expenses

2022 Tax Organizer

Tax Organizer